Today’s OspreyFX foreign trading news blog will be focusing on a number of topics. We talk about the UK Parliament’s stopping of a no-deal Brexit and the threat of an early election. We also look at the rise of Singapore and the fall of Hong Kong as a finance destination. Finally, we comment on the possible recession on the horizon and how this can be a boon for OspreyFX customers.

Fears of no-deal Brexit recede

The drama in the UK parliament goes on with no end seemingly in sight. However, it does seem that a no-deal Brexit is now going to be blocked by parliament with 21 Conservative rebels voting against their own government. Today will see the possibility of a General Election so it would be a good idea to keep an eye on the pound.

Pound rises, UK economy in recession

In fact, a rise in sterling is picking up steam as an alliance of Rebel MPs seeks to pass legislation to stop a no-deal Brexit next month. The pound is currently up 0.61 per cent against the US dollar at $1.2158. It’s a considerable difference from yesterday, when the currency slumped below $1.20 to hit its lowest level since a flash crash in October 2016.

The country’s economy seems to be in recession already. UK services activity fell more than expected in August, increasing the possibility that the country is slipping into recession amid slowdowns in manufacturing and construction.

Subscribe to our newsletter to receive our weekly updates + more straight to your inbox!

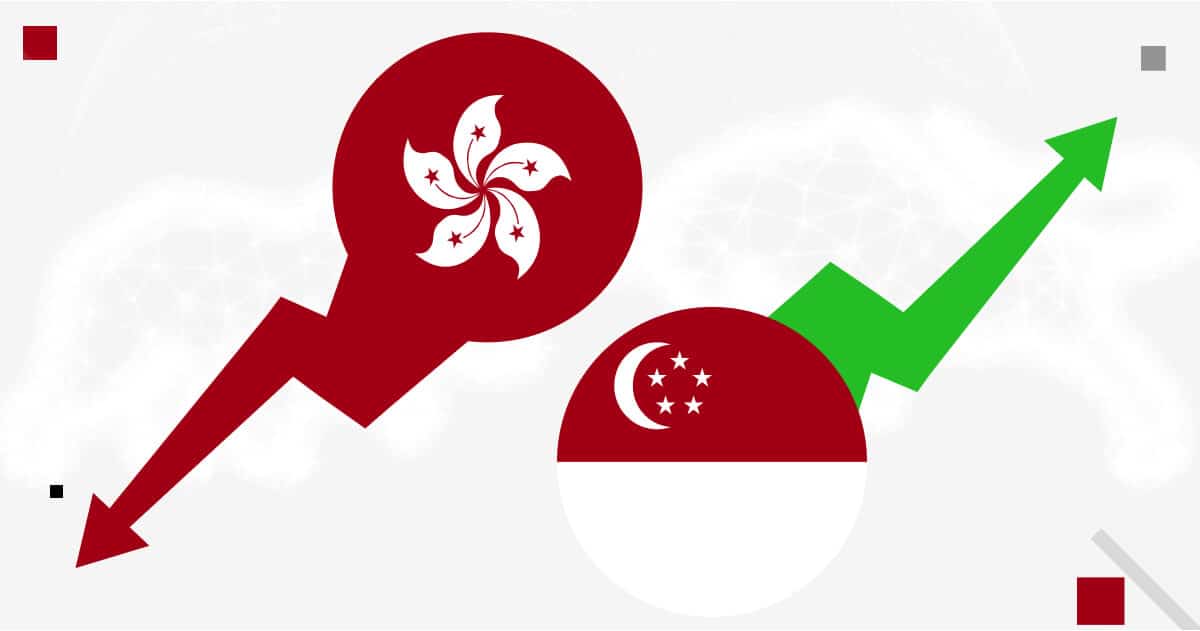

The rise of Singapore

As the Brexit turmoil continues, it may have gone unnoticed in financial circles that Singapore has risen considerably in global trading rankings. With New York, London and Tokyo still at the top with regards to trading, Singapore has quietly eclipsed everyone else to slide into fourth spot. The small country is also a top blockchain investment destination.

Hong Kong declining

Singapore’s rise could be coming on the back of Hong Kong’s decline. With all the unrest happening of late, the economy there is tanking. Industries such as tourism and real estate have seen massive slumps of almost 40% when compared to last year. Rising tensions and the US trade war with China have also taken a toll on the country’s reputation as a financial destination.

Global recession on the horizon?

With US manufacturing output down for the first time in three years, a recession looks ever more likely in the near future. Although this could mean pain for millions of people, there are actual opportunities for trading as bargains may be snapped up.

Osprey FX users could do worse than follow what’s going on in the financial world to be better placed for opportunities.