The OspreyFX Guide to Swing Trading: Everything you Need to Know

*OspreyFX would like to state that traders should research extensively before following any information given hereby. Any assumptions made in this article are provided solely for entertainment purposes and not for traders to guide or alter their positions. Please read our Terms & Conditions and Risk Disclosure for more information.

Everything you Need to Know to Begin Swing Trading

If we think of Physics, where mass times velocity determines the momentum of an object. Taking the financial markets, momentum is determined by factors such as trading volume and the rate of price movement. Swing trading is a strategy that focuses on smaller gains in short-term trends.

Here we bring you a short, easy-to-use guide with everything you need to know about swing trading including how it works, why it’s beneficial and 2 popular swing-based indicators that traders can use to get them started.

What is Swing Trading?

Swing trading, otherwise known as momentum trading, is a trading style that allows the trader to look for profit opportunities in market upswings and downswings. As the price changes, it moves in waves, from positive to negative, negative back to positive, and so on. These waves that occur in a given trend are called swings. Once an asset has moved to the upside, it takes a rest or pulls back before ideally continuing to move to the upside again.

Can I use Swing Trading to Supplement my Income?

Swing trading offers traders flexibility since they don’t hold any assets long term. Contrary to day trading, there is no commitment required, and a trader can choose to jump back into the market at any time.

Is Momentum Trading a Short-Term Strategy?

Yes! Swing Traders will look to seize profits from the movement of an asset over a period of a few days to a few weeks. Typically, traders will buy and sell the asset within a few days.

How can you Identify a Swing Pattern?

An asset’s price movement in an uptrend looks like a zig-zag motion that can be identified by a series of higher highs and higher lows. A swing trader identifies the pattern in these tops and bottoms as the entry and exit points of the swing trade.

Swing Trading: When to Buy

A swing trader will swing trade on an uptrend, meaning they buy on the pull-back. Swing traders seek to capture a short-term move that usually takes anywhere between one day to a week. Occasionally, some swing trade positions stay active for weeks or even months if they show a profit.

Swing trading also works in the opposite way, i.e., trading on the short side with an asset in a downtrend to profit from its price decent. In this case, the swing trader sells on the pull-up and looks to take profit at one of the lower lows as the move progresses to the downside.

Swing Trading Strategies

A swing or momentum trading strategy can be applied to any asset in any given time frame, from intraday to monthly. By incorporating technical analysis, a trader can predict short-term trends with some accuracy. Understanding how to spot those trends is essential to your success as a swing trader.

Swing traders rarely go above daily candlesticks. The preferred and most common time frames are daily and intraday since they serve best to identify the short-term trends.

Generally, a swing trader will define their position (pick entry, exit, and stop-loss) before it opens, as they can pinpoint in advance the exact levels they anticipate. Using candlestick charting, they seek to find an asset that’s trading in an intermediate-term uptrend. They would then wait for the asset to reach a higher low, i.e., the pull-back, and once the asset price reaches this point, the swing trader goes into the market.

Swing Trading Strategy Indicators

Swing traders depend on indicators to help them identify potential swing patterns. Both indicators and patterns can help identify tops, bottoms, support and resistance, and reversal levels.

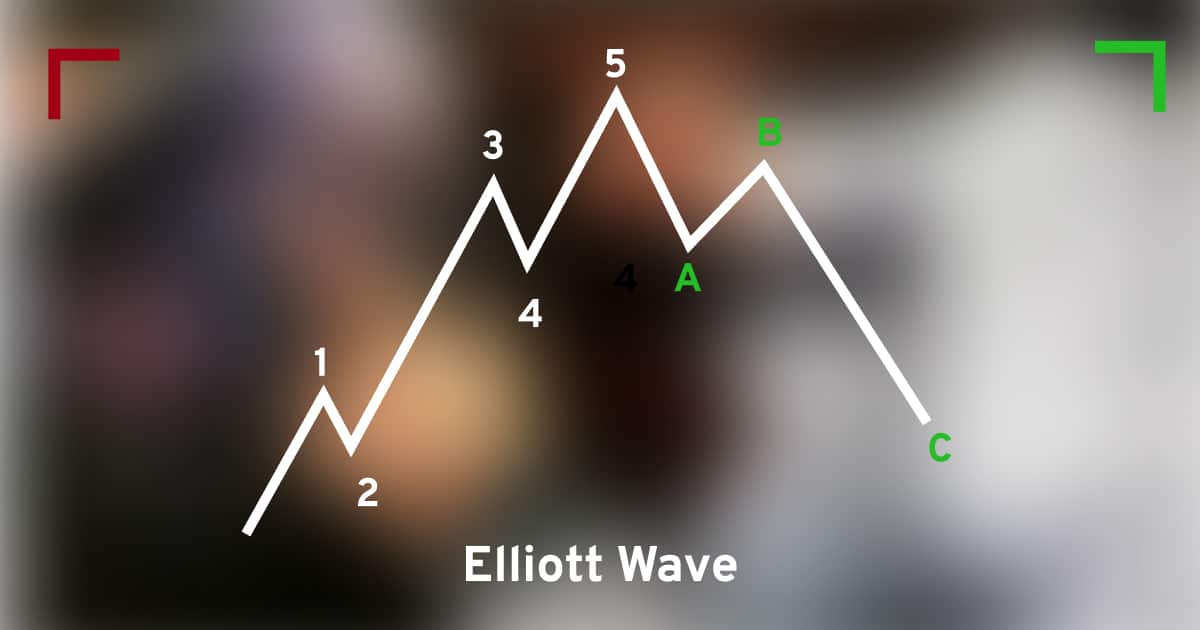

Perhaps the most well-known pattern for swing or momentum trading is the Elliott Wave. It consists of a five-wave structure that defines the uptrend, followed by an ABC wave that identifies the start of the downtrend.

Another useful indicator used by swing traders to identify opportunities is the Fibonacci retracement model. It helps to recognize support and resistance levels, which are horizontal lines representing the percentages of the trend: 23.6%, 38.2%, and 61.8%, or the golden ratio. The aim is to see whether the price will bounce off or break out of any retracement levels.

The Benefits of Swing Trading

Time

Swing trading offers flexibility to the trader, and contrary to day trading, it doesn’t require constant supervision. A trader can find success on a part-time basis by analyzing the market for a few minutes every day.

Reduced Pressure

Since assets are held longer, swing trading is less stressful than intraday. A trader can take time to examine the market, for a pattern and seeing that it is not the sole source of income, is under no time constraints.

Short Term Strategy

A trader profits by capitalizing on the market swings in the short term. As a result, your trading capital isn’t tied up for long and is available for any future trades.

The Risks of Swing Trading

Higher Margin Requirements

Firstly, swing trades are generally held over a few days and therefore require increased margin requirements.

Subject to Overnight and Weekend Price Gaps

Secondly, a swing trader will be holding an asset for a few days and is subject to any price gaps that can occur overnight or during the weekend. In some cases, market news or other reports influence the price to a point where a stop-loss wouldn’t be able to protect your investment.

OspreyFX Tip: Why not minimize the risks of price gaps by reducing your lot size? You can also lower the leverage until you gain enough experience in swing trading.

Timing is Everything

Finally, a swing trading strategy takes time to master, as it involves technical analysis. It can be challenging for novice traders to identify the right time to enter and exit a trade.

Final Takeaway

Successful swing traders have a strong understanding of both the financial market and technical analysis to identify trading opportunities. Incorporating a swing trading strategy on a part-time basis is a great way to supplement your income. Moreover, you aren’t required to be in front of a screen all day, so you can say goodbye to any distracting market noise.

Are you ready to try out a swing trading strategy? You can practice swing trading on a Demo Account risk-free! Alternatively, you can minimize your risk by trading one-tenth of a standard lot with a mini account.

Why wait? Sign up with OspreyFX today!