*OspreyFX would like to state that traders should research extensively before following any information given hereby. Please read our Risk Disclosure for more information.

Flexible Funding: Transactions with Credit/Debit Card

Trader’s Takeaways

- The benefits of using Credit/Debit Cards when trading

- A guide for trading using these transaction methods

- OspreyFX – Seamless Withdrawals & Deposits

Credit and Debit cards offer traders a method of payment that allows them to avoid the risks associated with paper money. Moreover, they don’t only provide an alternative to hard cash they offer more freedom while spending.

Credit cards, work as a loan system, where users can pay the amount credited over monthly installments. The downside of this is it’s interest-bearing credit, meaning traders can end up paying high levels of interest back to their provider.

For those traders that aren’t avid credit card users, the option for a debit card is also widely popular. You can easily deposit and withdraw funds from your trading account using an existing bank balance. These methods can be even more secure than funding via credit card as it does not include any interest on the amount deposited.

Transactions with Credit/Debit card offer many benefits for traders. Through step-by-step processes coupled with images and detailed explanations, we gift readers with a quick and easy to understand guide on everything they need to know when depositing and withdrawing via this secure funding method.

Subscribe to our newsletter to receive our weekly updates + more straight to your inbox!

Why Fund Transactions via Credit/Debit Card?

Easy, Secure, & Cost-Effective

OspreyFX pride themselves on offering a simple and transparent fee structure for all deposit options. We take the safety of our traders very seriously, by providing a highly sophisticated and secure payment process we make it easier for traders to make deposits without worrying about the safety aspect of making a credit card payment.

When depositing via credit or debit card the total amount that can be legally funded back to your card is the same amount that you fund your trading account with. You can take all other profits out using either Bitcoin or Wire/Bank Transfer.

A multitude of Financial Providers

We live by our values to work with leading financial providers, and there is a large array of companies and brands available to our clients. We work with big providers such as Visa, MasterCard, American Express, and countless other providers.

Instant Funding

The advantage of attaching your debit card to your trading account is that it provides instant access to your profits. Once you have closed a trade, you can withdraw the cash from an ATM soon after.

Your Questions Answered

Everything you need to know about depositing & withdrawing via Credit or Debit Cards. Can’t find what you are looking for? Pop over to our FAQs page or for those who prefer that human touch contact a member of our 24hr support team.

Withdrawing via Credit/Debit Card (Direct)

If you have made a deposit using a credit/debit card via a 3rd Party Platform not directly with OspreyFX, your funds would need to be withdrawn via Bitcoin, read how here.

If you have made a deposit using your credit/debit card directly with OspreyFX, you would need to withdraw/partially withdraw the same amount via credit/debit card unless otherwise informed by our Payments Team at the time of withdraw request.

The withdrawal will be processed by us within 24 hours and can take 1-5 days to be returned to your account (this depends on the speed of your bank).

Additional funds over and above your original deposit(s) would need to be withdrawn via a different method that credit/debit card.

Example: If you deposit $100 via Card and have a balance of $200 in your OspreyFX Wallet, we have to process $100 back to Card and then we can send the other $100 to your Bank Account or to a Bitcoin address should you look to withdraw the balance of the $200.

How?

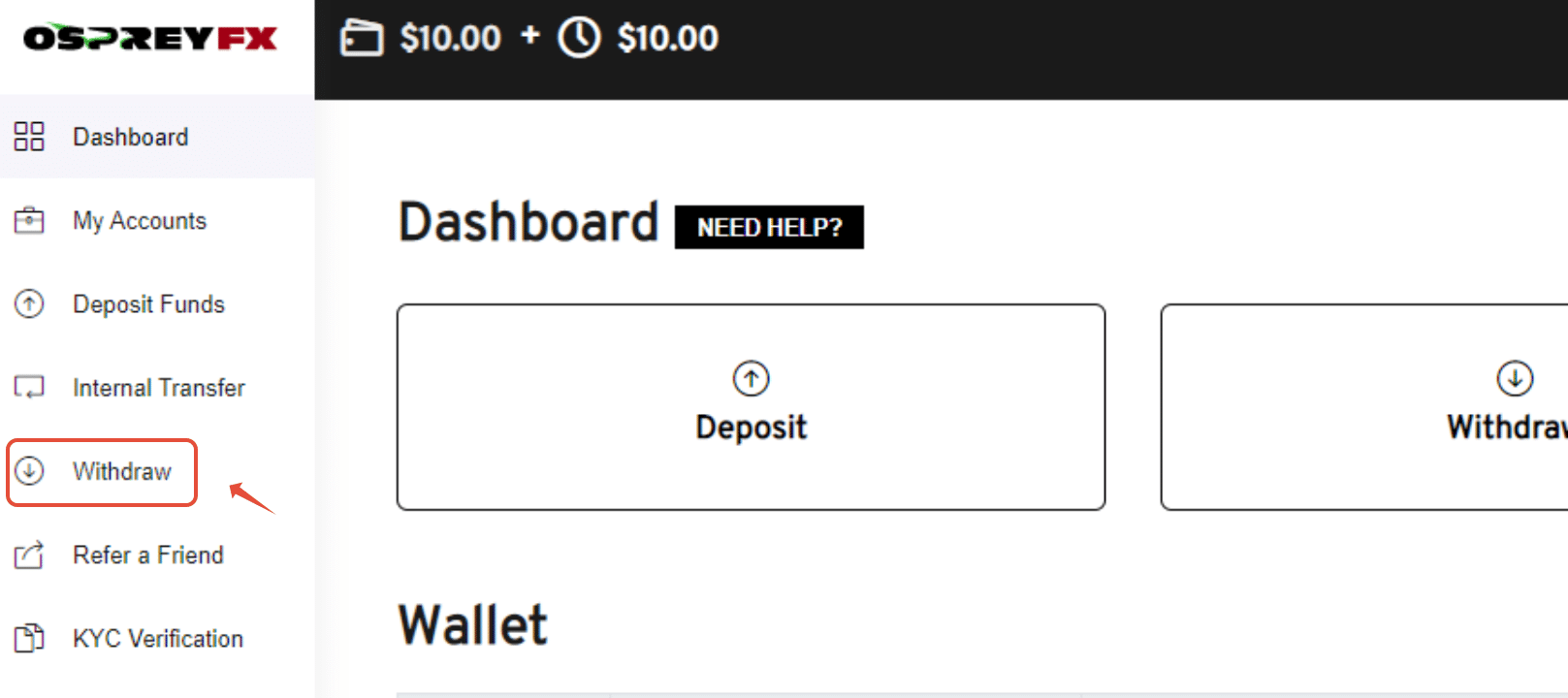

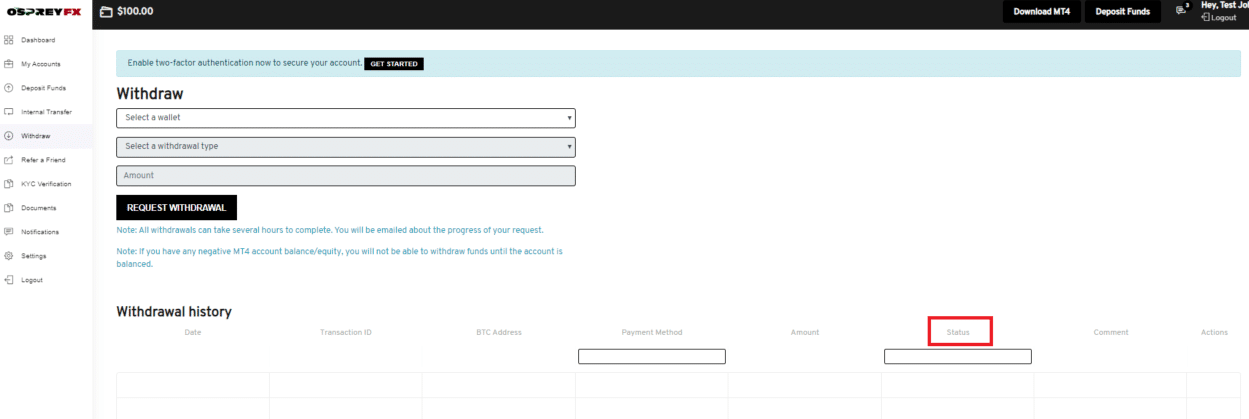

Step 1: Navigate to the “Withdraw” tab on the left-hand side menu.

Step 2: Select your USD Wallet and “Debit/Credit Card ” as the withdrawal method.

Finally, select the amount that you would like to withdraw. You would need to withdraw/partially withdraw the same amount via credit/debit card unless otherwise informed by our Payments Team at the time of withdrawal request.

Step 3: Click “Request Withdrawal” to complete your request.

This will be processed within 24 hours and an email will be sent to you to confirm that you requested has been approved.

You should receive the funds back to the original card they were deposited from within 1-5 business days.

If you have not received your withdrawal within 7 business days, please contact our Support Team with a copy of the card statement showing that funds have not been received so that we may investigate further. Please truncate any data that is not relevant to the request.

How to Pay with Credit / Debit Card on OspreyFX?

You will need to log in to your account and click on the “Deposit” tab.

If you are using a 3rd Party Platform to deposit:

- Select the “Credit/Debit Card” option.

- Enter the amount you wish to deposit.

- Click “Proceed to the payments page”.

You will need to complete the payment and enter your card details on the 3rd party provider website to complete sending funds to OspreyFX.

Funds will then shortly be added to your OspreyFX Wallet and visible within your Account.

Please Note: We support a number of payment gateway service providers. Please ensure you are aware of the Descriptor that will be shown on your bank statement.

If you are using our direct credit/debit card deposit option:

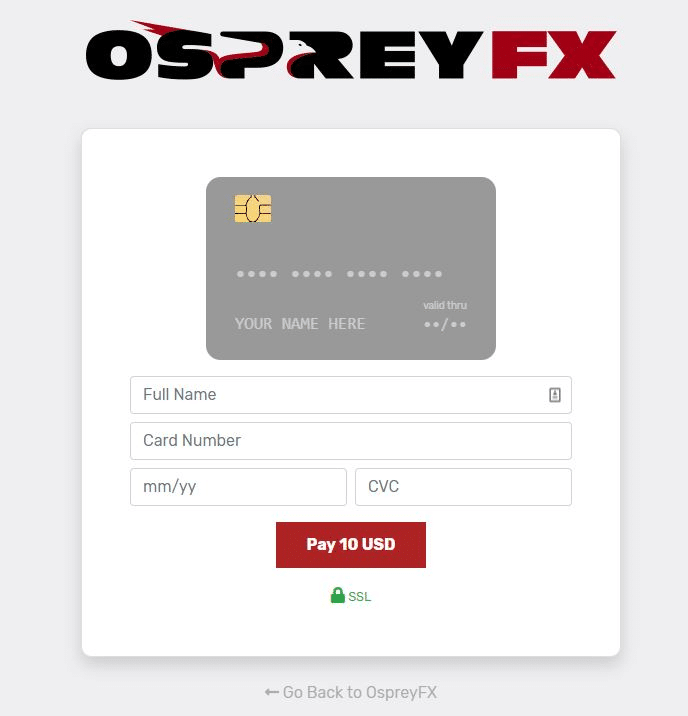

Step 1:

After clicking on the “Deposit” tab, select the option for the “Credit/Debit Card” option.

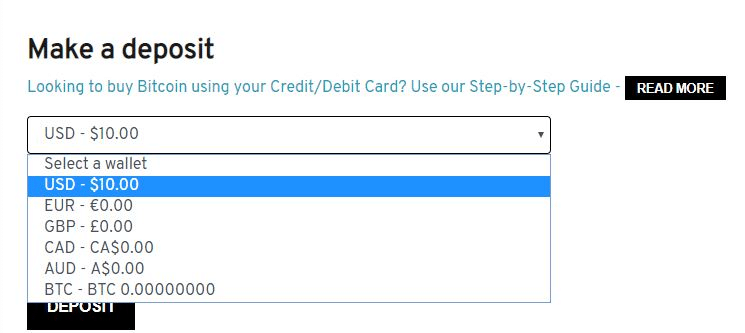

You will be redirected to the payment portal to enter your card details. For this example, we will use the minimum of $10 USD as the amount to deposit.

Our Guidelines for depositing via credit/debit card direct on OspreyFX are as follows:

- Min $10

- $1500 Max (Per transaction)

- Max 3 transactions per 24 hours (Per card)

- Max 10 transactions per 30 days (Per card)

Note: VISA and MasterCard are the accepted card types and the above Guidelines may vary depending on your card issuer’s guidelines.

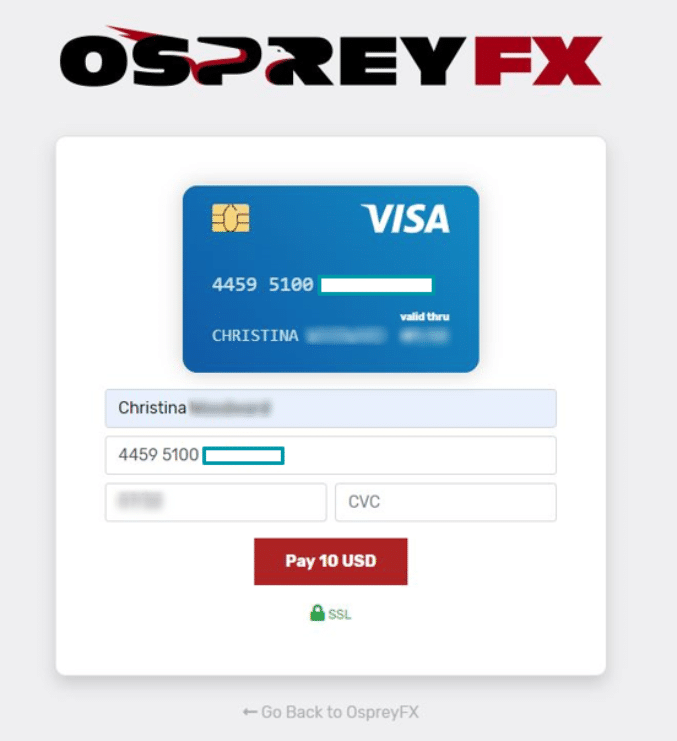

Step 2:

Once you have entered in your 16-digit card number and expiry date, our payment portal will recognize your card to be either VISA or MasterCard, which will auto-design the card image on screen.

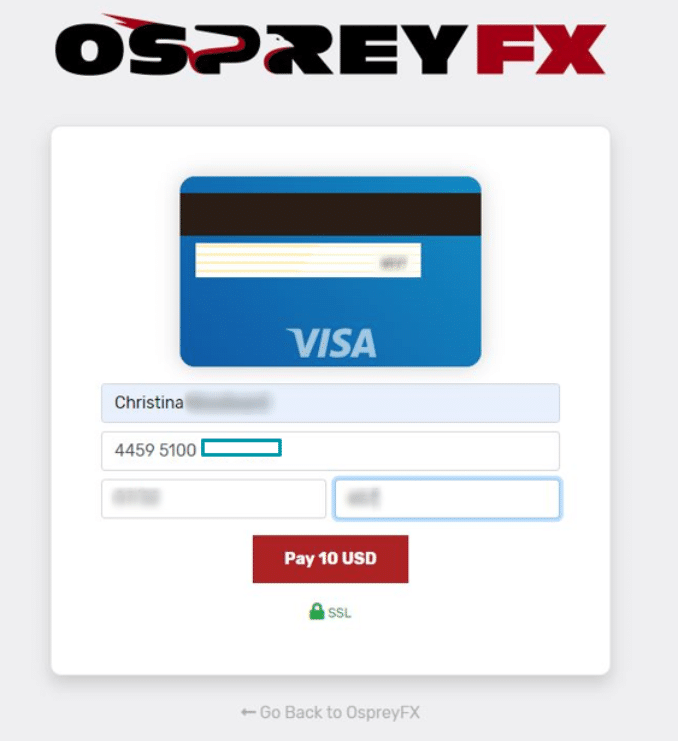

When you proceed to enter your CVC number (last 3 digits on the back of your card) the card image will turn as below:

Step 3:

Once you have entered your complete set of card details, proceed to click on “Pay xxx USD”.

The system will confirm that the payment is being processed by changing the status of the red button to “Loading…”

Step 4:

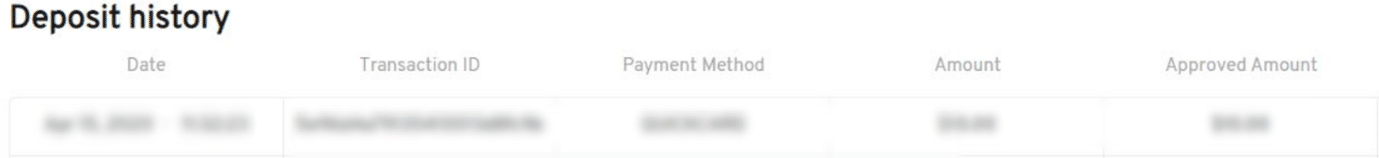

A successful payment will redirect you back to the “Deposit” tab in your Account. You will be able to see your deposit show immediately in your “Deposit History” and the funds deposited will be sent to your Wallet.

We partner with multiple processors to ensure the best quality of speed and service; therefore descriptors may vary for transactions noted on your card statement.

Step 5:

Your final step would be to fund your Live Account by making an Internal Transfer.

How Much are the Withdrawal Fees on OspreyFX?

There are no fees included to withdraw or deposit your funds via credit or debit card.

Can I Still Trade if I Deposit Less than $50 on OspreyFX?

You can trade with $5, depending on your leverage.

For example, if you have 1:500 leverage you could buy 0.01 lots of GBPUSD at 1.23322 and the trade would cost $2.47 not including commission fees. Whereas if you did the same with leverage of 1:100 it would cost $12.33 (again no commission included).

You would be limited in the instruments that you could trade as some have higher contract sizes or lower leverage. Indices and commodities have lower leverage so you would require more money to open a position.

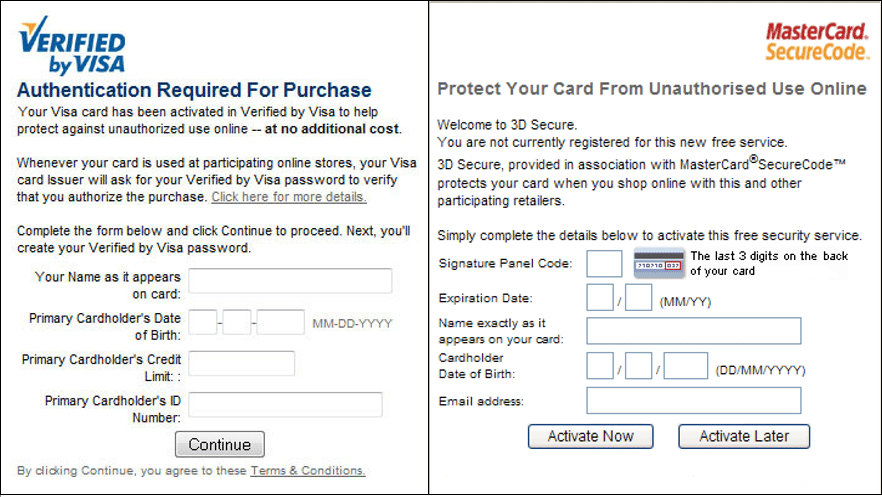

What is 3D Secure and Why is it Affecting my Deposit by Card?

3D secure is a security protocol that helps to prevent fraud in online credit and debit card transactions.

If you are depositing by card, the payment gateway may ask you for your 3D Secure code.

What is it?

3D Secure stands for 3 Domain Server, there are 3 parties that are involved in the 3D Secure process:

- The company the purchase is being made from.

- The Acquiring Bank (the bank of the company).

- VISA and MasterCard (the card issuers themselves).

The scheme is a collective of Verified by VISA (VBV) and MasterCard Secure Code (MSC). It is the most recent fraud prevention initiative that is available at the moment.

When using a 3D secure card, you may be, brought to a screen to enter your Master Card Secure Code or your Verified by VISA Code. Some banks will text you to ensure this is a transaction you are making.

Once you complete this 3D secure process you can use the card without any issues.

Contact your bank for any questions about whether your card is 3D Secured and to learn more.

What Will Appear on my Statement if I Use my Debit/Credit Card?

We make it our goal to work with leading liquidity providers so that we can offer the best quality of speed and, service and security, to that end descriptors may vary for transactions.

My Withdrawal Hasn’t Reached me yet

If you have deposit funds in your account and you cannot find them, Kindly ensure that the following has been checked:

An average of 2-3 business days has passed for the funds to be returned to your card, based on the speed of your Bank.

Note that descriptors may vary as we partner with multiple processors to ensure speed and security. If processing time has reached more than 5 business days, please contact our Support Team via Livechat or email: [email protected].

You can also check the status of your withdrawal when you are logged into your account. All you need to do is go to the Withdrawals page and at the bottom, to see your history.

There are a few payment statuses you will see when making a withdrawal. You will find the statuses below:

Waiting Process

A customer has requested a withdrawal.

Pending

We have either requested additional information from you to which you would have received an email, or we are completing part of our internal processes.

Drafted

Going through a standard security check.

Approved

The withdrawal has been approved

Rejected

We rejected the withdrawal (You will find the reason in the comments section)

OspreyFX – Seamless Withdrawals & Deposits

At OspreyFX we strive to give our traders the necessary tools to trade successfully. This includes secure withdrawals & deposit methods 7 days a week. We make it our goal to work with the best in the business and are continuously adding to our list of providers. Furthermore, we offer a wide range of funding options and do everything in our power to ensure that the process is fast and straightforward. This way traders can enjoy their profits as quickly as possible. Start trading with us today and benefit from segregated fund accounts, banking with tier-one banking institutions, and sufficient risk management.