Weekly Digest: A Round-Up of the Week as it Happened

*OspreyFX would like to state that traders should research extensively before following any information given hereby. Please read our Risk Disclosure for more information.

Weekly Digest: A Round-Up of the Week as it Happened

Traders Takeaways

- Your Weekly Wrap

- The Future of Payment

- The Week Ahead

With the European Central Bank (ECB) press conference on Thursday and the Consumer US Price Index announcement on Friday, regulatory bodies are scrambling to buttress the world’s economies. So, what impact did this have across the markets? Here we bring you a weekly digest with a concise overview of market action from the past 7 days and what you can expect in the coming week.

Subscribe to our newsletter to receive our weekly updates + more straight to your inbox!

Your Weekly Wrap

The European Central Bank

No significant hurdles emerged following the ECB’s announcements. With the monetary policy unchanged, ECB president Lagarde indicated that there will be thorough monitoring of exchange rate developments. Although data from July’s policy meeting pointed towards strong rebound inactivity, it was noted that we won’t see a return to pre-pandemic GDP levels before 2022.

The euro’s strength was a central point of the discussion, however, Lagarde stated that the exchange rate was “not a policy target” because of its overall impact on inflation. Market sentiment about the euro is positive and many experts are optimistic that the rally will continue. At the time of writing, the euro is up 11% against the greenback following March’s lows and 1.7% against the sterling. A policy shift could weigh on inflation and affect overall recovery from the coronavirus pandemic. This could be similar to the dollar’s patterns in August after the US Federal Reserve implemented a more dovish policy and the new average inflation target triggered a weaker dollar.

Earlier in September data proved that for the first time in 4 years the eurozone had slid into deflation, as consumer price inflation was -0.2% for August down from a rise of 0.4% in July. Despite this drop, Lagarde announced that the ECB will raise its forecast for inflation for 2021 in addition to increasing the growth forecast for this year. With a plan to boost spending, eurozone inflation will climb from an average of 0.3% to 1% over the remainder of 2020 and 2021.

So, What Happened in the Market?

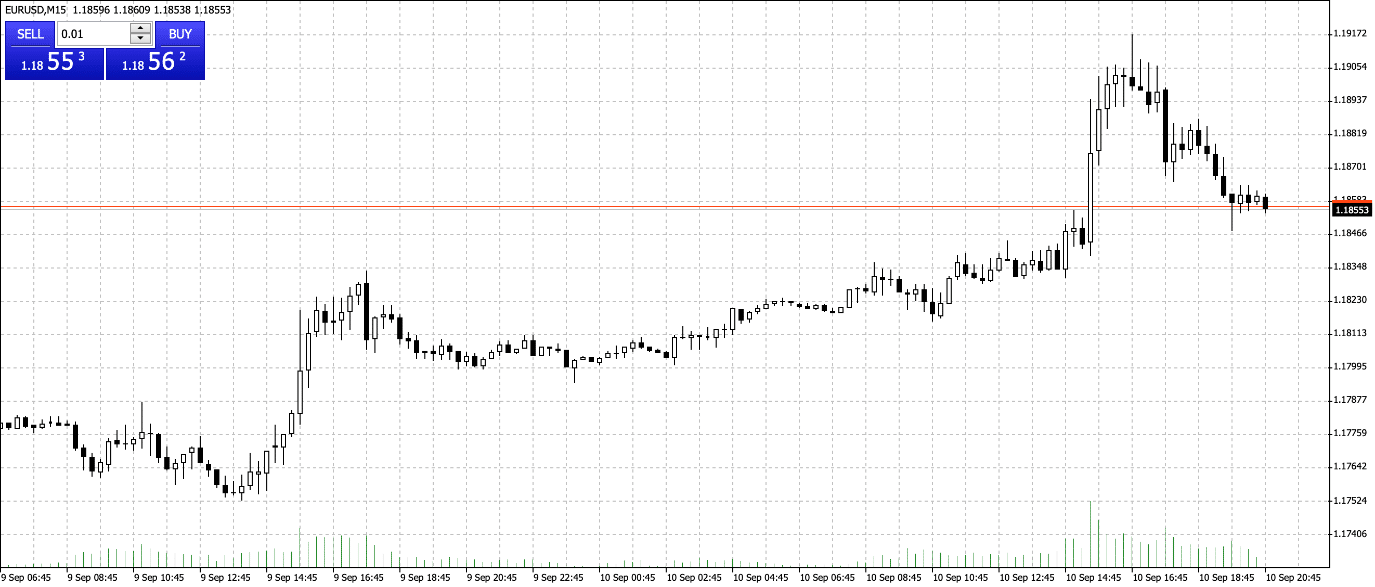

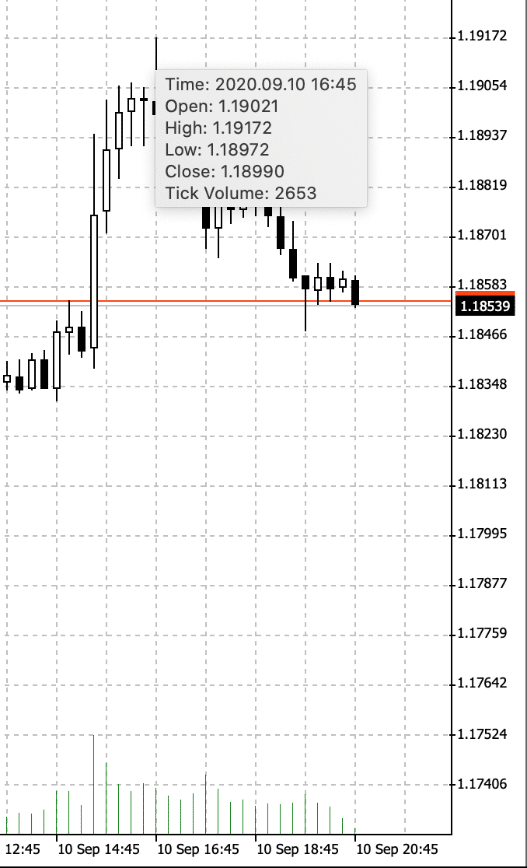

In the lead up to the ECB announcement EUR/USD traded sideways but hit new daily highs during intraday trading and finished the day 0.6% up. Moreover, the hours following the publication of the press release at 1.45 pm, saw a swing of over 65 pips on EUR/USD and therefore creating the potential for traders to earn up to $650 per lot traded if they got in and out in a timely manner.

In other markets, UK investors had reason to be optimistic as UK stocks finished strong despite global stock markets grappling. The rise in stocks derived mainly from a weak pound, as the currency witnessed its poorest week since March.

Market Movers

- Sterling falters 3.6% vs dollar, finishing at 1.28, 5% off the yearly high of 1.34. Despite the drop, the currency remains 11.5% higher than its March low of 1.15.

- Overall, the FTSE gained 3.4%, as the FTSE 100 proves to be the leader, up 4%, and the FTSE 250 index rose 1.2%.

The Future of Global Payments

Following on from the ECB conference Lagarde also spoke at the Deutsche Bundesbank conference where she focused on the growth of digital payments. Indeed, she discussed two major trends that are shaping the global payment landscape:

- A shift in consumer preferences

- Competition to dominate payments on a global scale

The digital revolution has and will continue to change how we live and operate in our daily lives. According to Lagarde, presently more than 4 in 5 Europeans use the internet regularly. Jump back two decades and this number was at a more modest 1 in 5. COVID-19 has further accelerated the trend towards digitalization as people searched for new meaning in the art of communication and as our lives become more digital, so have our payments. One initiative that was discussed to strengthen European payments was the introduction of an ECB digital currency, with the ECB President stating that the central bank is currently looking into the benefits of these digital innovations but also the risks that they pose. Will we see the introduction of a digital euro that shakes up our current financial system? Only time will tell, but we are certainly excited by the prospect.

Read our detailed guide to get a full synopsis on blockchain disruption and how it has impacted the financial industry.

U.S. Consumer Price Index

The report presented by the US Labor Department on Friday indicated that US consumer prices rose steadily in August. The CPI gained 0.4% for August, heavily driven by the cost of used cars and trucks (accounting for more than 40% of the rise with a jump of 5.4%), gains in the cost of gas and recreation, and household furnishings. Despite declines in the 3 months before June, the CPI has shown strength advancing 0.6% in both June and July. Moreover, over the last 12 months through August, it has seen a 1.3% increase. These gains are the largest in nearly two decades.

The report on Friday also highlighted a hardening in underlying inflation pressures. However, as the Federal Reserve rewrote the framework in August with emphasis shifted towards the labor market and less on too-high inflation, the reinforcement will have no impact on the monetary policy.

How did the CPI Data Affect the Markets?

In the lead up to Friday, the US market struggled for purpose – dropping 2.5%, as stocks recorded the second week in decline. This decline was heavily driven by big technology stocks dragging the market lower.

Market Moves:

- Tech makes up a whopping 30% of the US market at present and witnessed a drop of 3%. The sell-off in technology is highly influenced by valuation concerns, leading NASDAQ to fall into correction territory, down 10% since the new highs on September 2nd. Despite this, COMP is still trading 20% up, year to date.

- S&P 500 Index was down 2.5% last week, but up 3.4% YTD as DOW trades -1.7% remaining 3.1% higher YTD.

Nevertheless, stocks opened and closed Monday (September 15th) higher as tech shares seem to rebound, but the dollar remains choppy and is trading slightly lower than its peers. Equity markets showed momentum as a result of optimism surrounding a vaccine breakthrough.

What’s Coming Up?

The primary focus this week is on key central bank meetings, with both the Bank of England and the Bank of Japan convening on Thursday, September 17th.

The sterling may continue to be undermined by the concerns looming around Brexit. So, traders may see volatility surrounding the pound.

Finally, the spotlight on the US will light up on Wednesday as traders anxiously await the outcome of this week’s FOMC meeting. No policy changes are expected, but USD exchange rates may be influenced by the Fed’s forward guidance amid speculation that the recent changes to its inflation targets could pave the way for more monetary easing.

Is Market Volatility a Friend or Foe?

In times of market volatility, traders can be presented with an array of new opportunities. It also creates an opening for investors to diversify their portfolios and avoid growing risks.

So, why not sign up with OspreyFX and benefit from a broad range of trading assets and make your foray in the financial markets today.