About Slippage:

Slippage is when your fill price is different from your expected price and it can go both ways, for you or against you.

A high degree of slippage usually happens when the market is Volatile. This could be due to:

- Change in interest rates.

- A major reveal from a company.

- Civil unrest in a country.

It affects all trades at some point, even if you have a stop loss or take profit in place. There are 2 types of slippage:

- Gap Slippage.

- Partial Slippage.

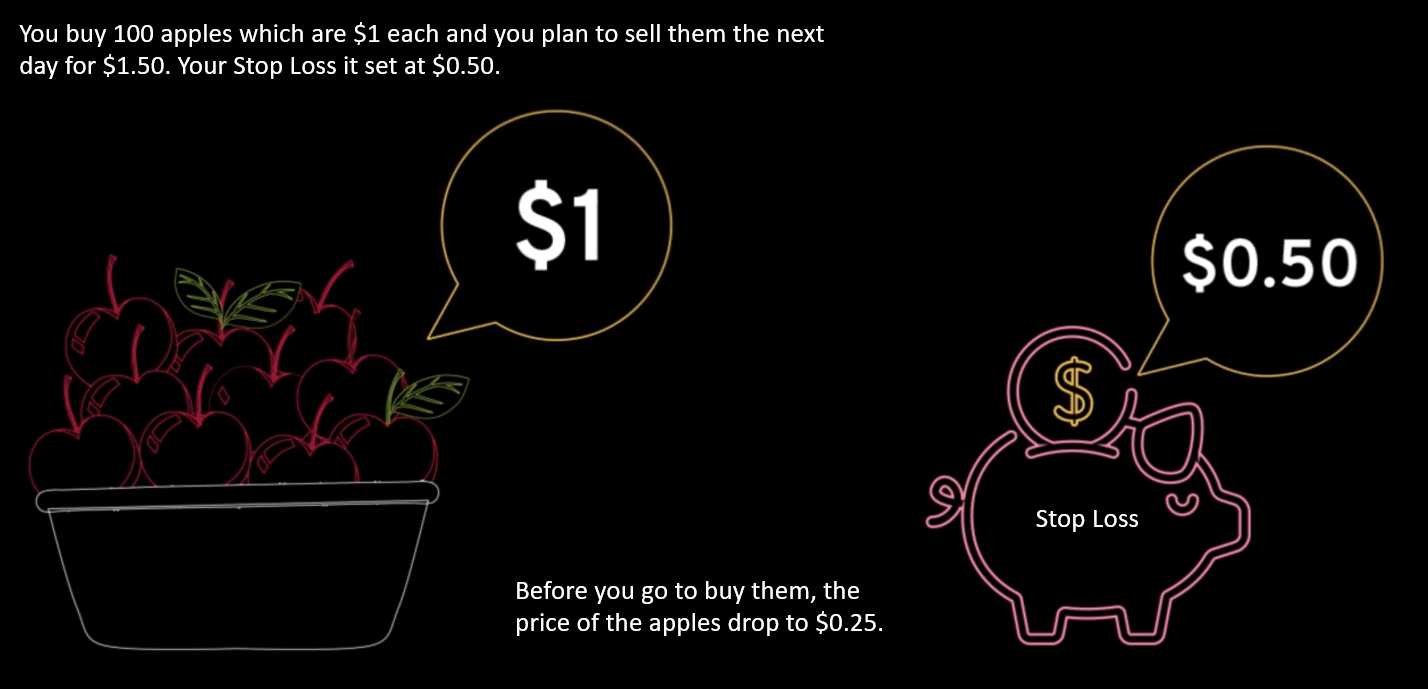

Gap Slippage:

When you go to buy or sell your lots, the price fluctuates and the order is changed to the new market price.

Example:

The opposite could also happen and the official price for apples goes to $0.75 and your lot/s are sold at the best market price available.

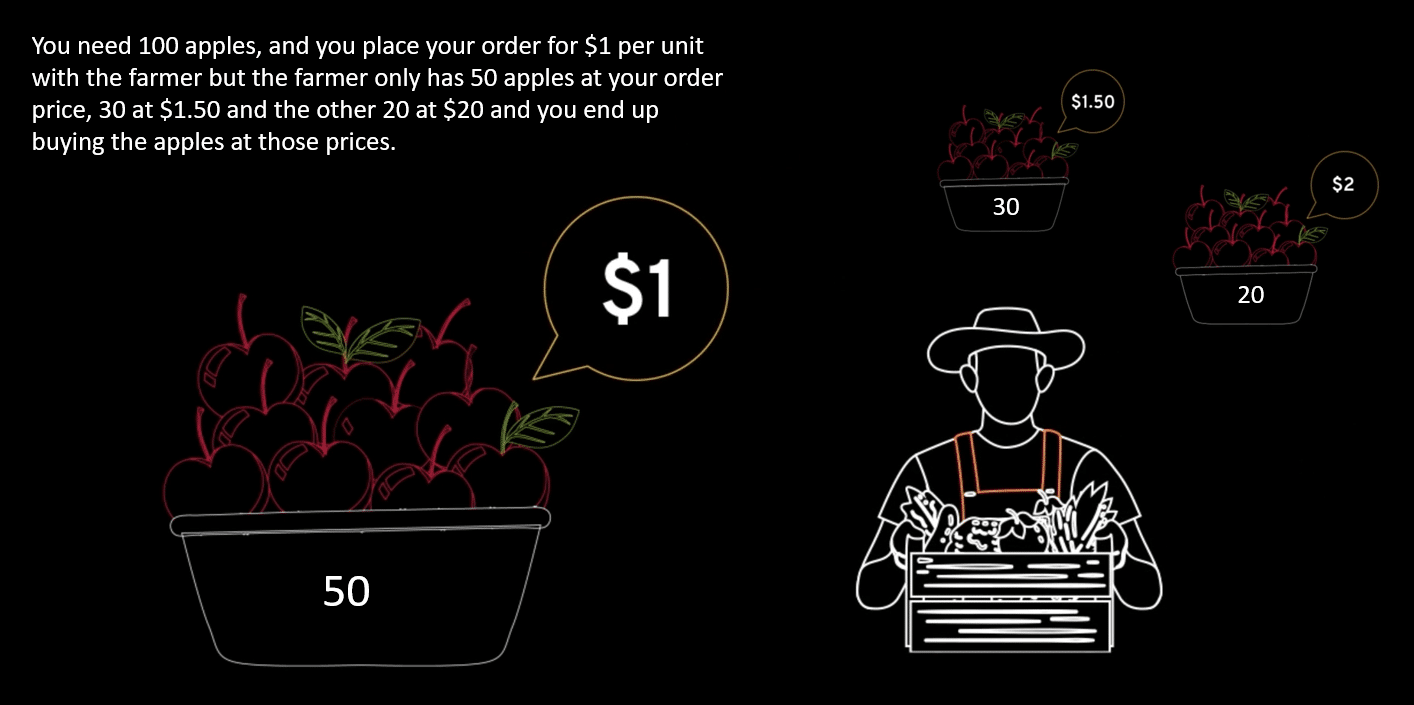

Partial Slippage: Is when there is tight liquidity in the market.

When you go to sell your lots at a certain price however due to liquidity in the market the demand is not there to buy all your lots at the price you would like to sell and there is a dual set of lots in your order that goes to the next lot price leaving your average take profit higher or lower than you originally anticipated.

- That’s why it’s important to pay attention to the market and to try and anticipate what is coming next.